PREAMBLE

In a document created by McKinsey & Company titled The Infrastructure Moment we were presented with a perfect outline for the overall structure of the IDFS, INC Project.

Infrastructure is a critical component of long-term global economic growth, supporting all modern societies, elevated standards of living, and every modern industry.

The report estimates that a cumulative $106 trillion in investment will be necessary through 2040 to meet the need for new and updated infrastructure. The required investment spans seven critical infrastructure verticals:

1. Transport and logistics will require the largest share ($36 trillion).

2. followed by energy and power ($23 trillion)

3. digital ($19 trillion)

4. social ($16 trillion)

5. waste and water infrastructure ($6 trillion)

6. agriculture ($5 trillion)

7. Defense ($2 trillion)

The ongoing expansion and evolution of what infrastructure comprises has transformed its definition, demanding a fundamental mindset shift among governments, investors, and industry operators about how to fund, build, use, and maintain it. Even as infrastructure verticals are evolving individually, their new intersections form another aspect of evolution.

A confluence of global forces is accelerating the need for infrastructure investment. Outdated assets, rapid urbanization, geopolitical shifts, and technological advancements are exposing the limitations of yesterday’s infrastructure.

These forces are also changing the very definition of infrastructure. Traditionally, the term has been synonymous with assets such as power grids, roads, ports, and bridges. More recently, advances in technology have meant that newer assets such as fiber-optic networks, hyperscale data centers, and electric-vehicle charging stations are increasingly vital. These modern types of infrastructure share traits with “traditional” infrastructure, including long lifespans, significant initial investment, predictable and resilient cash flows, and critical economic roles.

A supporting layer of specialized services—maintenance, inspection, compliance, and remote monitoring—ensures these assets remain operational and are increasingly considered to be infrastructure as well. Governments and investors must fund these supporting services alongside critical assets.

At the same time, the boundaries between infrastructure verticals are blurring. Many of today’s most critical needs—such as infrastructure to support the deployment of artificial intelligence and the energy transition—exist at the intersections of the verticals. This report explores these intersections in depth and reveals why a siloed approach to infrastructure planning and investment may no longer be viable. Governments, investors, and operators will want to reflect on these interconnections and pursue integrated strategies that best deliver the mix of infrastructure that society needs to prosper.

Private capital is playing an increasingly important role in delivering infrastructure that sits at these intersections and within verticals. Private infrastructure assets under management surged from about $500 billion in 2016 to $1.5 trillion in 2024, reflecting its new position as the most desired asset class for increased investment. Investments will focus within and at the intersection of seven critical verticals, which this report explores in depth: energy, power, and resources; transportation and logistics; agriculture; digital and communications; waste and water; social; and defense.

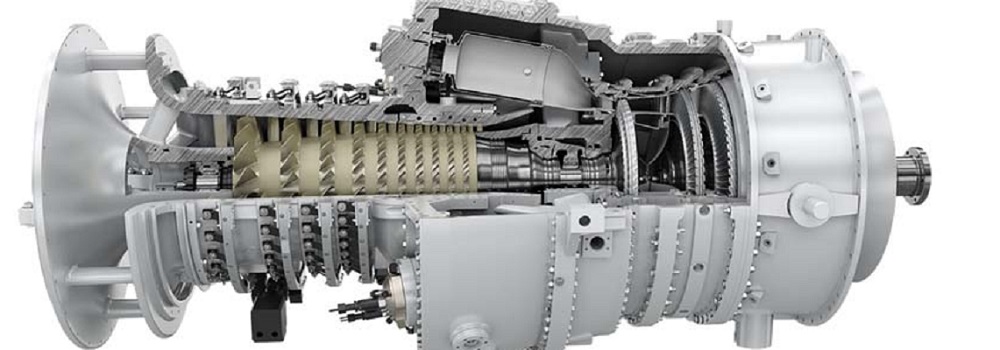

AscenTrust, LLC., an existing Texas corporation, wholly owned by it's Senior Engineer, was Incorporated in 2009 to act as a joint venture with an Australian Investor who was going to finance the prototype of the NTPBMR (Nuclear Technology Pebble Bed Modular Reactor) project. The Pebble Bed Modular Reactor Technology was then the leading contender to the SMR (Small Modular Reactor) initiative.

The Company now offers a broad range of Consulting and Value Engineering, in the Oil and Gas Industry and the Electrical Infrastructure industry. We are presently going through the due-diligence and negotiation phase, with one of the foremost Quantum Computing Companies in the US. If our negotiation is successful we will become a strategic partner with the Company in Question and will provide Project Management to the Company

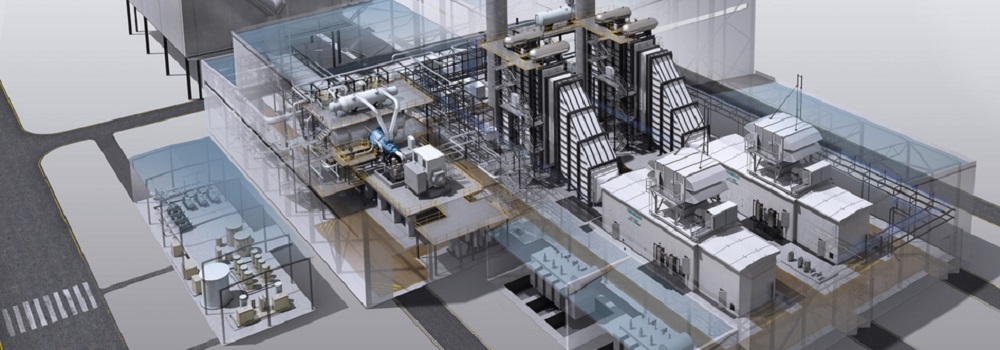

IDFS, INC. (International Diversified Financial Services, Inc.), an existing Texas corporation, wholly owned by the Senior Engineer of AscenTrust, LLC., is the Corporate Entity which will own and operate the Matagorda Power Project and will own the Intellectual Properties of the Grid Synchronization technologies. The first phase of the power Project consists of the construction of a 560MWe, combined cycle power plant. Building this facility will establish the Company as an Independent Power Producer (IPP) in the State of Texas. When IDFS has been registered with the Public Utility Commission of the State of Texas, we will proceed to the Second phase of Funding.

NITEX (Nitex International, LLC), an existing Texas Limited Liability Company, wholly owned by the Senior Engineer of AscenTrust, LLC.. Nitex is being used as the Corporate vehicle for the refinery project in Louisiana which will be referred to in our documentatin as the Pelican Bay Refinery Project

Advanced Software Development, Inc. , was originally Incorporated in the State of Delaware in 2000. The Senior System and Software Developer was working on the implimentation of a HIPAA (Health Insurance Portability and Accountability Act) compliant Electronic Medical Records to be used in the rural medical clinics which we were designing and building for a local medical practitioner (In the Conroe area of Montgomery County, Texas). When the internet bubble burst we were left with nothing more than a working prototype which we had installed on a laptop running Windows XP. All of the software being developed by the Senior Project Manager of AscenTrust, LLC. or his strategic Partners is being developed under the DBA of Advanced Software Development, Inc. .